🚨Emergency Broadcast pt. 2: Whales of War (wide release)

How the whales Friday are being proven right, and what we found today

📉 THE FALL-OFF Pt. 2: Whales of War

A YEET Emergency Bulletin

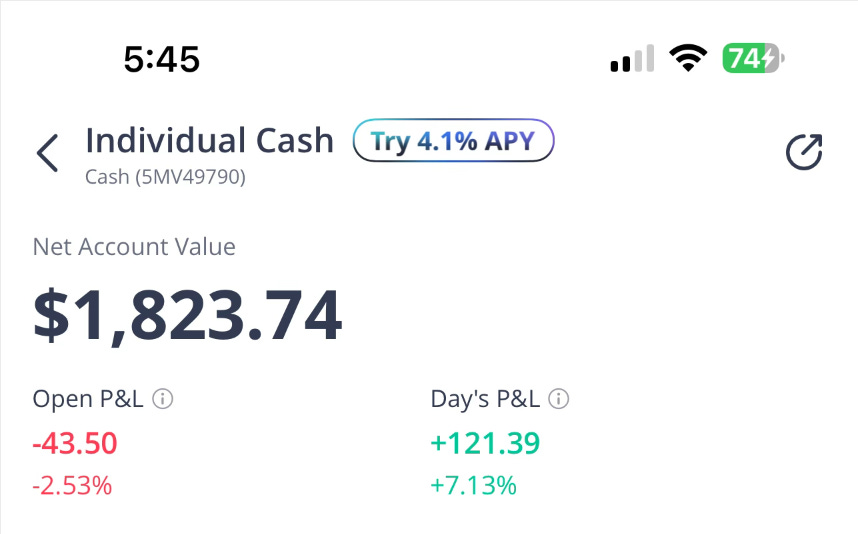

PS Milt’s Magical Challenge for YEET Plus: Day 3 — Account up +80%

War tensions. FOMC looming. Whale positioning shifting.

Markets are quiet—but the data is screaming.

We’re up +80% in just three days of the Milt’s Magical Challenge, and we’re not easing up.

Our SPY puts are still in play overnight, and the filters have one message:

🛑 Risk-off is here.

🔮 FILTER STATUS CHECK

🧠 SPY MAGIC

Clean contract clusters across 3–10 DTE. High success rate on near-money setups.

🦄 SPY UNICORN

Directional confirmation algorithm. Confirms the macro intent of flow clusters.

🚀 SPY MAGIC: BALLISTIC (NOW LIVE for PLUS, preview here, plus full contracts below)

Our newest variation—designed for wartime markets and inflection points.

Filters for aggressive premium clusters + timing around CPI/FOMC/geopolitical

Triggered hard on 6/13 and again today.

Every put we’re holding was flagged by Ballistic or confirmed by Unicorn

📊 WARI IS FIRING ON ALL CYLINDERS

🧠 WARI (Whale Action Risk Index): 82/100 — Flashing RED

Let’s walk through why.

🔻 PUT CLUSTERS STACKED BELOW CURRENT SPOT THIS PAST MONTH

Repeated hits on 600P, 597P, 595P, 585P, and even 582P

These aren’t just hedges. These are directional conviction plays by size players

Large contracts at $500K–$1.2M premium, often across multiple DTEs

⏱️ SHORT-DATE CONVICTION

1–3 DTE plays dominating the feed

High percentage of 100% ask-side premium fills

Tagged with “Repeated Hits” + “Ascending Fill” = institutional aggression

🌐 OVERLAY: GLOBAL RISK + MACRO HESITATION

We’re not only seeing this behavior during U.S. hours. A clear pattern is forming:

Overnight and premarket whale activity is increasing, often ahead of Middle East headlines

Positioning is aligned around potential Sunday futures gaps, a known tactic during global risk

💡 VOLATILITY & IV PRESSURE

IV is rising into rallies for many of these puts—a classically bearish signal

Traders are paying a premium to stay exposed before Powell even talks

📉 FOMC MACRO DATA UPDATE (June 11 CPI)

Headline CPI (YoY): +2.4%, up from April’s +2.3% bls.gov

Core CPI (YoY): +2.8%, steady from April; matched consensus

Monthly CPI (May): +0.1%, down from April’s +0.2% reuters.com+5bls.gov+5jpmorgan.com+5

🔍 FED IMPLICATIONS

**Headline Inflation Moderate**

‒ Up 0.1% MoM and 2.4% YoY—neither shockingly high nor low.

‒ Suggests stable but non-threatening price pressures.Core Inflation Still Sticky

‒ At 2.8% YoY, it remains well above the Fed’s 2% target, and unchanged from April

‒ Keeps the door open for continued policy restraint.Fed Rate-Cut Outlook Softens

‒ Markets now price in no cut at June’s FOMC, and possibly one quarter-point cut by September, instead of earlier

‒ Combined with geopolitical risk, this is reinforcing our risk‑off stance.

🧨 WAR? FOMC? BOTH?

Could this be war hedging?

Very likely. Headlines are dropping overnight, especially:

Israeli intel leaks

Iran escalation rumors

Oil spiking and softening in sync with global headline timing

But equally likely is that whales are:

Using the cover of geopolitical chaos to front-run a macro-driven flush.