🐋 The Great Crypto Whale Blowoff Top of 2025?

Not a top for crypto equities — just MARA feeling the pressure while other tickers get set to run

🐋 The Great Crypto Whale Blowoff Top of 2025?

This past week brought one of the strongest waves of bullish flow we’ve seen across the crypto equity complex in months. Call activity surged across the board — HUT, COIN, and RIOT — with sizable, coordinated entries and confirmation via open interest. But not everything moved in sync: MARA stood out as the clear laggard, with heavy put flow landing on key gap levels and timing that raises questions about its trajectory.

Let’s break it down:

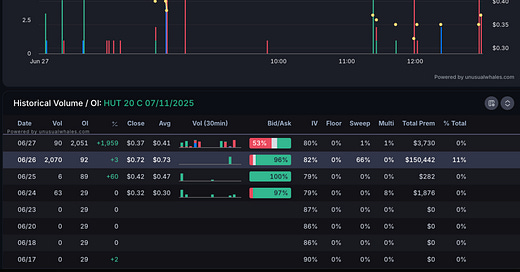

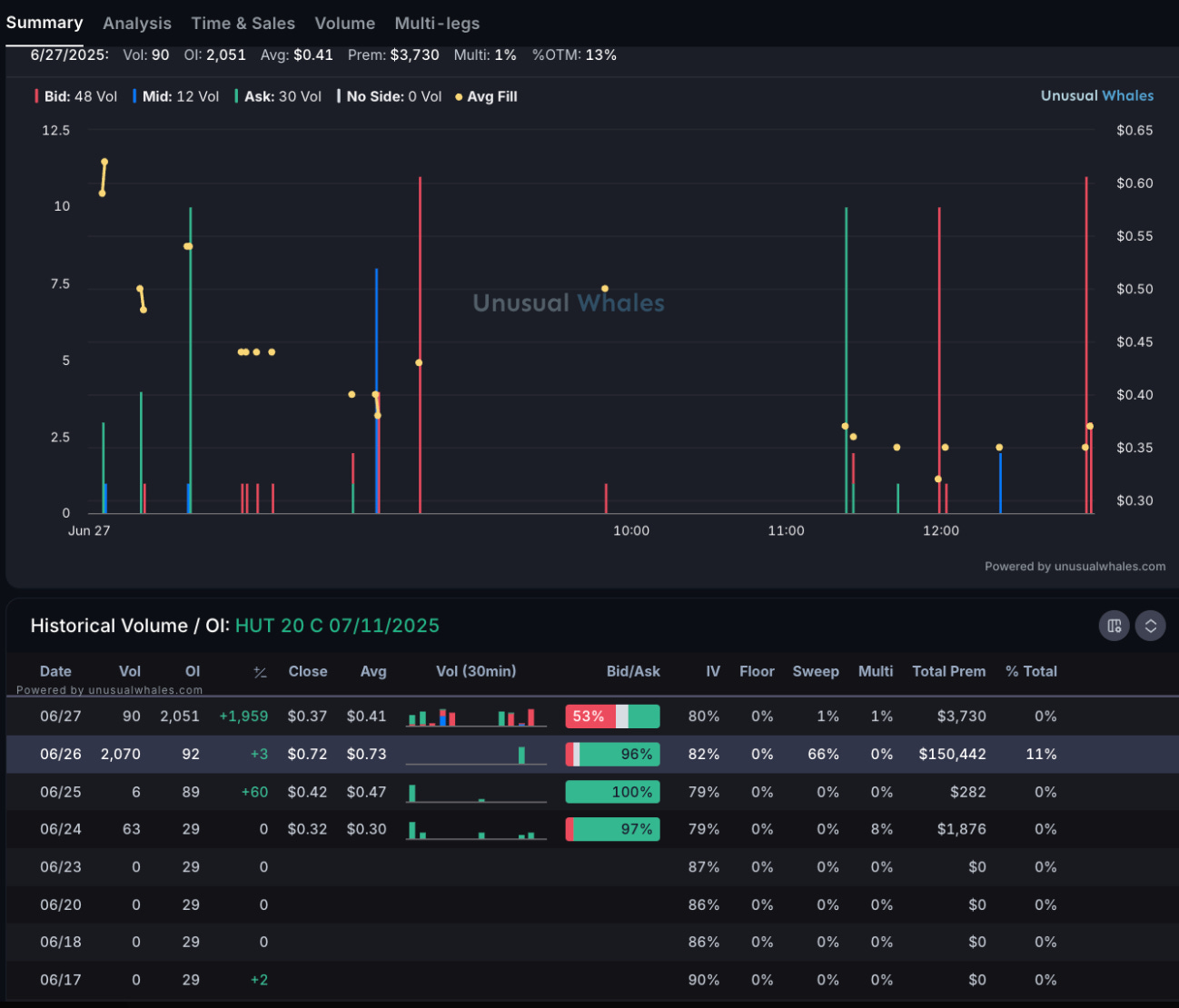

🟩 HUT: Confident Call Positioning

Thursday was a breakout flow session for HUT:

$190K+ premium flowed into the 20c 7/11

Another $134K was allocated to 20c 8/15

This wasn’t scattered flow — it was concentrated and structured. The increase in OI on both strikes confirms follow-through and positioning, not short-term flipping.

🧭 Interpretation: This looks like conviction. Whales may be viewing HUT as a leading vehicle for crypto equity upside — especially with cleaner fundamentals and relative strength compared to MARA.

🟩 COIN: Top-of-Chain Flow, Still Climbing

Call buying surged Thursday across multiple strikes and expirations:

380c to 425c, across early to late July and even July 25th, were picked up in size.

Flow captured across The People’s Screener Reloaded, which is soon to be automatically pushed to Discord for YEET Plus users.

🧭 Interpretation: This isn’t panic-chasing — it’s structured momentum flow. Multiple whale-sized entries point to further upside bets and continuation potential into July earnings and macro catalysts.

🟩 RIOT: Quiet Confidence

Friday’s session brought a solid $96K position on the 13c 7/18, and earlier in the week saw supporting bullish entries as well.

While not as loud as COIN or HUT, RIOT’s flow is steady and directional — no signs of hedging or hesitation. It may be a secondary vehicle for whales looking to scale without size constraints.

🧭 Interpretation: RIOT is likely riding the beta wave behind COIN and HUT, with healthy upside flow and no evidence of defensive posturing.

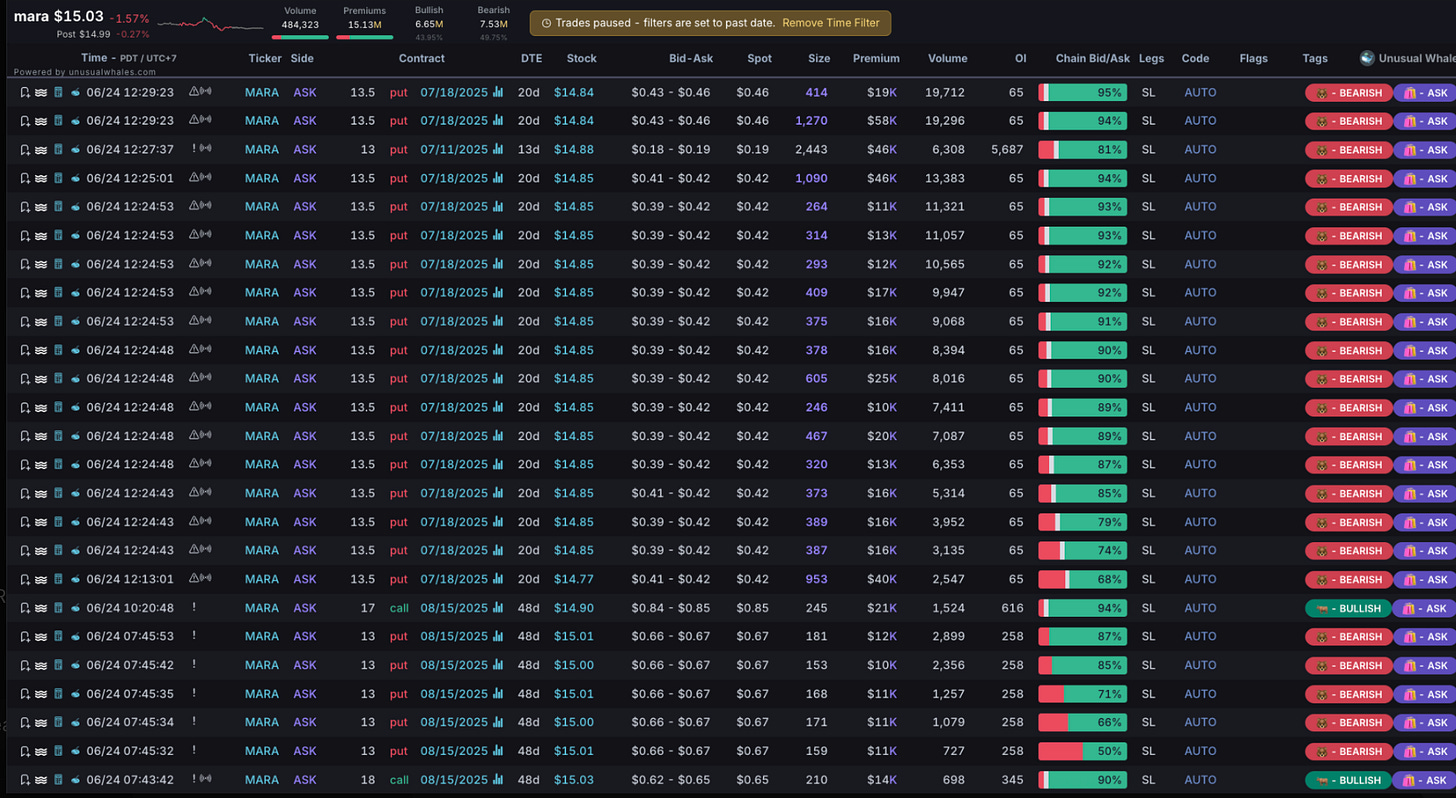

🟥 MARA: The Outlier

On June 24th, MARA received concentrated put activity:

13.5p 7/18/2025 → $850K+ in premium

13p 8/15/2025 → $220K+

13p 7/11/2025 → $132K single order alert

All three landed within hours of each other — not as a hedge, but seemingly a targeted downside thesis. That same day, MARA underperformed its peers on price and volume.

🧭 Interpretation: This is less about crypto macro, and more about MARA-specific pressure. Dilution concerns, underperformance, and potential structural issues could be behind the divergence. The puts appear strategic — possibly pointing toward a gap-fill toward $13.4 or lower.

🧠 Summary: Rotation, Not Reversal

Despite the title, we’re not calling a top. The flow doesn't support it. If anything, whales are rotating into higher-conviction names (HUT, COIN) and stepping away from MARA for structural reasons (a gap to 13.4)

This isn’t a blowoff — it’s a recalibration.

Watching this week:

Can HUT confirm with continuation and new inflows?

Do COIN’s short-dated calls roll forward or cash out?

Does MARA flow shift from puts to spreads or closeouts?

How RIOT plays catch-up in a rising crypto tide