🤔 Where Do We Go From Here?

Looking at QQQ and SPY historical momentum and volatility metrics to suss out the Price Action

🧠 What is PARI?

PARI (Price Action Risk Indicator) blends:

📈 Momentum – is price surging or stalling?

💥 Volatility – is risk shrinking or exploding?

📊 Trend Persistence – how consistent is the move?

It’s scaled between 0-100, where:

🔴 Low = High uncertainty, shaky trend

🟢 High = Strong conviction, clean price action

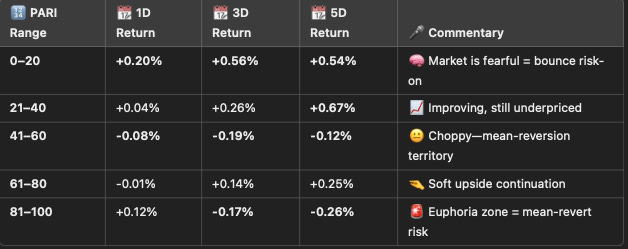

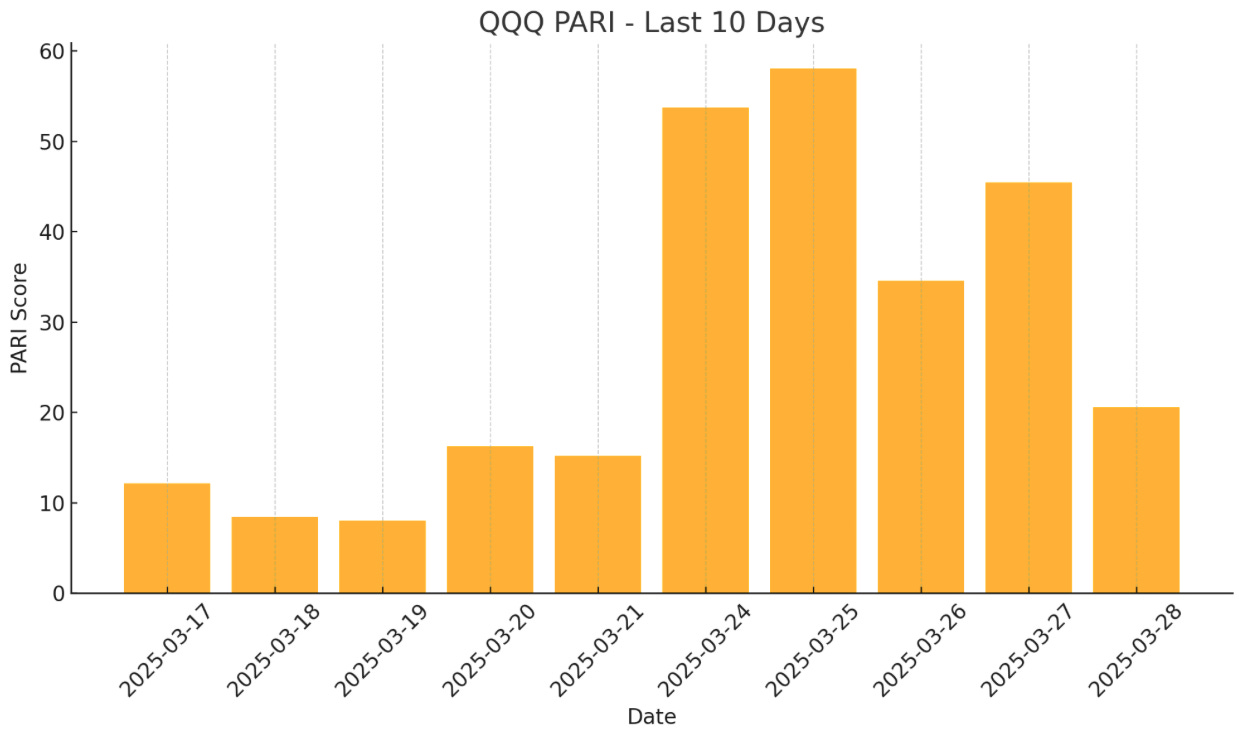

📉 QQQ PARI – Last 10 Days

Narrative:

QQQ’s PARI fell off a cliff early in the 10-day stretch, recovered sharply mid-week, then lost steam again by March 28.

🔎 Breakdown:

🧊 Mar 18-20: Danger zone (PARI < 20) = extreme uncertainty

⚡ Mar 24-25: Big bullish pop in momentum

🤷 Mar 28: Retreating again (likely a failed follow-through)

🔢 Visual:

⚔️ QQQ vs SPY PARI – Battle of the Indices

🎯 What We See:

🔁 SPY = More stable PARI curve

🧨 QQQ = High variability, choppier signals

🟡 Both peaked Mar 25, showing shared market optimism

🧵 Interpret This:

🧠 SPY is acting like the adult in the room – controlled, dependable

🎢 QQQ is moodier – more susceptible to reversals and emotional price swings

🧪 If you're trading tech, use tighter risk and watch PARI slope changes

🔢 Visual:

🧮 Simple Model: Can We Predict 3-Day Direction?

We built a logistic regression model — dead simple, interpretable, and surprisingly effective at catching short-term moves.

🛠 Features Used:

📈 PARI — current score

🔁 ΔPARI — change from previous day

💥 Volatility — recent risk backdrop

🚀 Momentum — how fast price is moving

✅ Model Stats:

Accuracy:

65.3%Target: Whether QQQ is up 3 days later

📌 Today’s Prediction:

📅 Latest PARI setup →

55.0%chance of upside in 3 daysThis means the model is leaning slightly bullish, but it’s a low-conviction edge.