😤 Pt. 1: SPY Flow, Levels, and FOMC Strategy

🐳 SPY Flow Snapshot

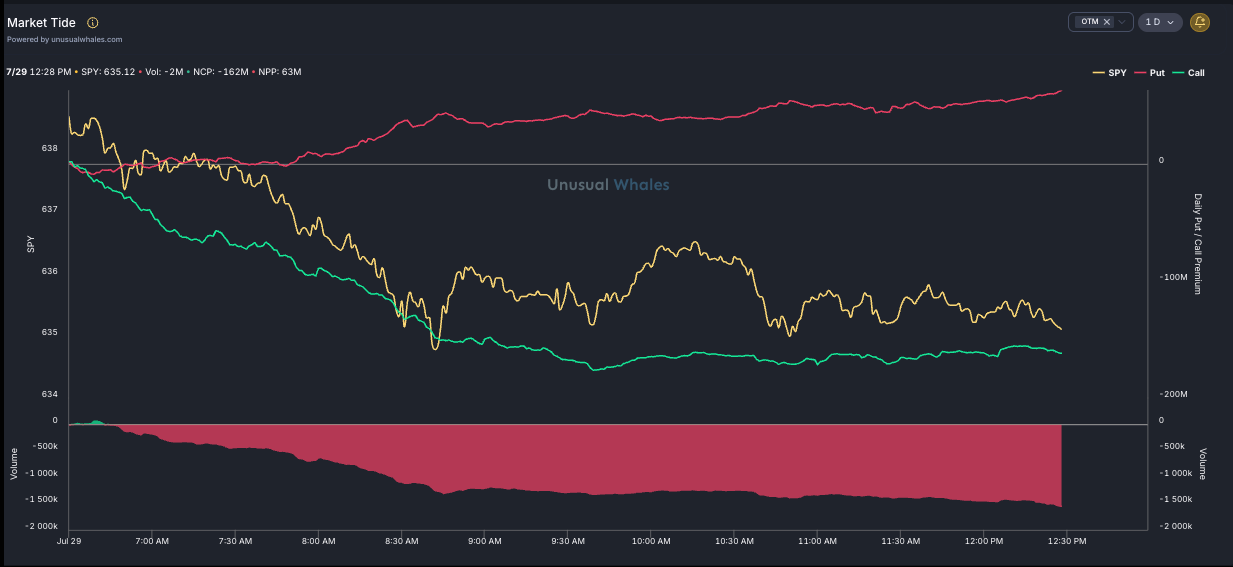

Market Tide Breakdown:

SPY started weak and stayed weak all session, drifting steadily lower.

Put premium dominance surged all day (red line climbing), while call premium got smoked.

Volume was net negative and deepening into the red by -2M contracts.

Net Call Premium (NCP): -162M, Net Put Premium (NPP): +63M

📉 Bearish lean across OTM sentiment with aggressive hedging leading the move.

🕵️ SPY Chart

We’re still near highs, and there’s a lot of air between levels — this sets up tomorrow as a high opportunity day.

🎯 Your goal: Let price come to the level, then react

🕵️ SPY Chart Levels (FOMC Key Zones)

⚠️ REMINDER: On FOMC days, the only levels that matter are the big ones: monthly magnets, gap zones, and historical pivot clusters. Everything else is turbulence. Because we’re hovering near highs, tomorrow offers real two-sided money-making opportunity if you respect the levels.

🔼 Upside Targets (if SPY rips):

637.51 → 638.56 → 639.88

Each reclaim confirms the next. Watch 638.56 for confirmation volume.

🔽 Downside Zones (drip-to-dip play):

634.56 → 629.43 → 626.88 → 626.09 → 626.01 → 624.84 → 624.69 → 624.61 → 624.20 → 623.71 → 623.33 → 622.99 → 621.80 → 620.67

Break below 634.56 is your first caution signal.

Bounce setups likely in the 626–624 zone, but if those fail, you’re looking at deeper washouts.